And the Mortgage Bankers Association, lobbyists for mortgage lenders, walked away from their own headquarters in Washington, D.C. in February 2010.

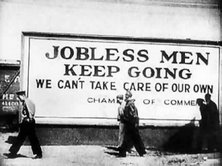

The American Dream. You remember that, right? Go to college, get an education, get a good job, buy a house, raise your 2.5 kids? That dream? Most Americans in my generation aspired to that or something close to it…and over the past few years it’s become increasingly clear that “The American Dream” is no longer what we may have been thinking it is. This may turn out to be a good thing in the long run, because Americans are now having to re-examine if what they’ve been told they need to aspire towards is really what they want and need.

The American Dream. You remember that, right? Go to college, get an education, get a good job, buy a house, raise your 2.5 kids? That dream? Most Americans in my generation aspired to that or something close to it…and over the past few years it’s become increasingly clear that “The American Dream” is no longer what we may have been thinking it is. This may turn out to be a good thing in the long run, because Americans are now having to re-examine if what they’ve been told they need to aspire towards is really what they want and need.

The first preconception in need of serious re-examination is the idea of home ownership. Growing up, I was taught that home ownership was sacred. Not only was it an investment (because real estate NEVER depreciates), but it was a civic obligation that created stable and strong communities. When you owned a home, you were invested in your community and its future. That was then; this is now…and it appears the calculus has changed for the worst.

Nearly one in every four homeowners across the country owe more on their home than it’s worth. Once a month, those 10.8 million are faced with a question that cuts to the core of the American Dream and offers a confusing collision between a deep-seated sense of personal obligation and a cold, simple business calculation: Should I pay my mortgage?

For decades, there was only one answer for most people: Of course I should keep paying, it’s the right thing to do. Besides, the argument went, a home is a great investment. Today, in the wake of the most seismic housing collapse in the nation’s history, that logic has increasingly been challenged by homeowners despondent about their lack of options.

Once upon a time, paying a mortgage was a sacred obligation, unquestioned in it’s place in the family priority structure. Now, one in four mortgages are upside down, and while one can still make a compelling moral argument for continuing to pay on a mortgage, it may no longer be a sound business decision. In an era when businesses can walk away from a mortgage obligation because it represents the lowest ultimate cost, there’s no longer a convincing argument for why homeowners shouldn’t have the same freedom. If business can forgo morality in the interests of making a “sound business decision”, why should that same right be denied to individual homeowners?

The reality is that things have changed. The American Dream is not what it once was, if in fact it really ever was all that. Families must now look at a home for what it is- an investment, a business proposition. All emotion, dreams, and aspirations aside, no business would continue to invest in something that had depreciated in value to the point where they were underwater. Many American families are now having to face the same reality- they’re a business, and if they resists making sound business decisions they’ll soon be insolvent and bankrupt.

Owning a home is no longer a sure-fire, guaranteed path to wealth and security. That’s not to say that it can’t still be that for some, but when one of four mortgages are underwater, it should be clear that the old assumptions no longer apply. In some cases, renting may well be a better financial decision. Sure, it goes against everything we as American adults have been taught, but it’s a helluva lot better than having to anguish over whether to walk away from a home you will never be able to pay off.

Things change. Dreams change. Realities change. Banks need to figure out how to adapt (or die) to the new reality. I’m not a banker, and it’s been over ten years since I worked in the mortgage industry, so I’m not going to pretend to have any answers. Americans need to re-examine their hopes, dreams, and expectations in order to determine what they want their “American Dream” to look like. Given the fraying of economic realities we’ve long taken for granted, this is probably a good thing. Americans may finally feel the freedom to define their “American Dream” in ways that previously might have seemed “unconventional”. None of our dreams are written in stone, and nothing is guaranteed. Ultimately, I think there’s some freedom in coming to grips with that.

America is a country built on innovation and creation…and we may well be at a crossroads, where that innovation and creativity is more important than ever. Rather then bemoaning homeowners walking away from mortgages they can never hope to pay off, perhaps banks and lending institutions need to develop more creative and adaptable products in order to facilitate home ownership. And perhaps Americans need to cast a more discriminating eye on the long-term financial commitments they make.

If handled with care, what appears to be a crisis may in fact turn out to be an opportunity. Be creative. Travel new paths. Adapt or die. As difficult and unpleasant as that prospect may seem, it’s one of the things that makes America great.

Is that light an oncoming train…or a light at the end of the tunnel? That remains to be seen…and the answer is largely up to all of us and our ability and willingness to adapt and change.