(Also published at Firedoglake and The Agonist)

WASHINGTON — The wealth gap between younger and older Americans has stretched to the widest on record, worsened by a prolonged economic downturn that has wiped out job opportunities for young adults and saddled them with housing and college debt. The typical U.S. household headed by a person age 65 or older has a net worth 47 times greater than a household headed by someone under 35…. [P]eople typically accumulate assets as they age, this wealth gap is now more than double what it was in 2005 and nearly five times the 10-to-1 disparity a quarter-century ago, after adjusting for inflation.

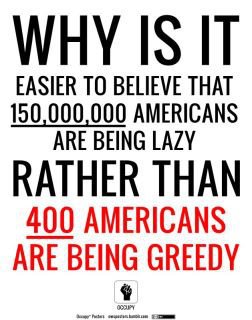

One of the triumphs of the Occupy Wall Street movement has been shining a blinding white light on the issue of income inequality. No one’s arguing for Socialism, though I don’t reflexively see anything wrong with the idea of spreading the wealth. Before you go off on me about how I’m anti-American, let me ask you a couple very simple questions. What’s so very uniquely and admirably American about an economic order which works to move ever-increasing amounts of wealth into the pockets of the already wealthy? What’s so quintessentially American about a system that’s impoverishing the younger at the expense of the older?

One of the triumphs of the Occupy Wall Street movement has been shining a blinding white light on the issue of income inequality. No one’s arguing for Socialism, though I don’t reflexively see anything wrong with the idea of spreading the wealth. Before you go off on me about how I’m anti-American, let me ask you a couple very simple questions. What’s so very uniquely and admirably American about an economic order which works to move ever-increasing amounts of wealth into the pockets of the already wealthy? What’s so quintessentially American about a system that’s impoverishing the younger at the expense of the older?

No reasonable person would argue that all wealth should be redistributed equally, regardless of who may be responsible for creating that wealth. Likewise, no reasonable person should be able to argue that maintaining the status quo is a sustainable model for a just and vibrant economy. Those who would refer to (and condemn) any adjustment of the current tax system as “Socialism” are, whether intentionally or not, advocating for an economic order based on inequality, unfairness, and self-interest.

If America is to retain it’s place atop the world’s economic food chain, there’s simply no way to do so without addressing (and resolving) the issue of income inequality. Condoning a system in which the vast majority of wealth trickles up to the already wealthy (and in most cases older) will ultimately relegate younger Americans to subservient subsistence jobs which will not allow them to support their families, much less save for their own retirement. The current system simply isn’t sustainable- the center cannot hold…because there no longer really is much of a center.

[T]he impact of the economic downturn, which…hit young adults particularly hard. More are pursuing college or advanced degrees, taking on debt as they wait for the job market to recover. Others are struggling to pay mortgage costs on homes now worth less than when they were bought in the housing boom.

The report…casts a spotlight on a government safety net that has buoyed older Americans on Social Security and Medicare amid wider cuts to education and other programs, including cash assistance for poor families….

While the wealth gap has been widening gradually due to delayed marriage and increases in single parenting among young adults, the housing bust and recession have made it significantly worse.

From where I sit, one of the most glaring problems revealed by this recession is the inequality created by our current tax structure. Over time, we’ve stood quietly by as Congress crafted a system designed primarily for the benefit of corporations and the already-wealthy. The tax burden has been shifted downward to allow the “job creators” to continue building up the economy (at least that’s what the propaganda said). That corporations have been parking their windfalls overseas as the wealthy hoarded their own windfall in various and assorted tax shelters is not exactly news. That those who benefit from this system are fighting tooth and nail to maintain their gravy train is understandable as it is reprehensible.

From where I sit, one of the most glaring problems revealed by this recession is the inequality created by our current tax structure. Over time, we’ve stood quietly by as Congress crafted a system designed primarily for the benefit of corporations and the already-wealthy. The tax burden has been shifted downward to allow the “job creators” to continue building up the economy (at least that’s what the propaganda said). That corporations have been parking their windfalls overseas as the wealthy hoarded their own windfall in various and assorted tax shelters is not exactly news. That those who benefit from this system are fighting tooth and nail to maintain their gravy train is understandable as it is reprehensible.

The top tax rate during the Reagan years was 50%; Congress has whittled that number down to 35%. This doesn’t mean that the overall tax burden has been reduced and government is smaller; it means that burden has been shifted downward onto the poor and the middle class. If Republicans have their way, this trend will continue, and the “job creators” (who don’t appear to be creating much in the way of jobs) will be allowed to keep a greater proportion of their income even as the poor and the middle class are expected to part with more of theirs.

This isn’t about Socialism. It’s not about the redistribution of wealth (but it is for Republicans in Congress). It’s about fundamental fairness and reforming a broken system so that today’s younger generation isn’t destined to be the servant class for the older and wealthier among us.

It’s time to do the right and create a fair and equitable economic system that asks more of those to whom more is given and reduces the burden on those among us least able to afford it. American middle-class families (and the poor) shouldn’t be saddled with onerous tax burdens to finance the lifestyles of the rich and influential. The ability to buy a Congressman shouldn’t provide license to jigger the tax code to your advantage.

WE DESERVE BETTER.