Pretty much every Bernie Sanders speech includes lots of railing against Wall Street. He’s even brought up the CEO of Goldman Sachs a few times. Well, that CEO has now responded. Lloyd Blankfein was on CNBC yesterday and, during a lengthy interview, was asked about Sanders calling him out personally. Blankfein said he’s never met the Democratic socialist candidate, so he doesn’t take it personally, but he does have some grave concerns about Sanders…. “It has the potential,” he argued, “to be a dangerous moment, you know, not just for Wall Street, not just for the people who are particularly targeted, but for anybody who’s a little bit out of line.”…. He framed Sanders as an extremist who refuses to compromise with anyone (though when asked if he supports Hillary Clinton, Blankfein deferred).

One of the things I love about Bernie Sanders is his commitment to holding Wall Street accountable. His very simple philosophy (“If it’s too big to fail, it’s too big to exist”) is something that should be de riguer- an accepted aspect of a sound, common-sense economic philosophy that rewards success and punishes excess.

One of the things I love about Bernie Sanders is his commitment to holding Wall Street accountable. His very simple philosophy (“If it’s too big to fail, it’s too big to exist”) is something that should be de riguer- an accepted aspect of a sound, common-sense economic philosophy that rewards success and punishes excess.

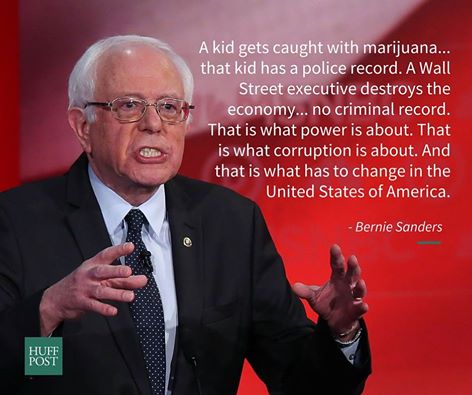

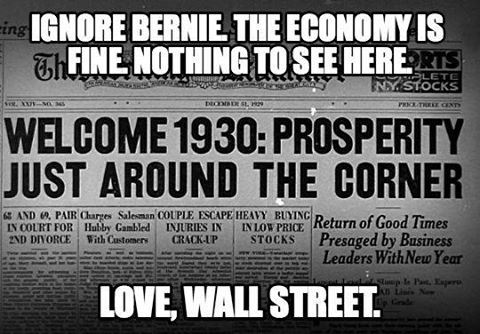

If Wall Street executives are running scared, then good on Sen. Sanders. They SHOULD be scared. For too long, they’ve been given the keys to the economy- only to treat it like a 16-year-old boy with a learner’s permit and a fifth of Wild Turkey. IF they play by the rules, they’d have nothing to worry about, and Sen. Sanders would be the first to agree. Play by the rules, live within the law, understand that the economy isn’t your personal plaything and that you’re not the Lord of the Universe, and no one will be the wiser…which is as it should be. The problem, of course, is that for far too long, Wall Street lords like Lloyd Blankfein have believed themselves to be above the law and greed to be their god. The federal government has too often confirmed and enabled that belief. Steal a thousand dollars and you can count on doing jail time. Steal a few billion, and you get a book deal and a consulting gig on CNBC or Fox Business Channel.

I can hear the detractors now…”What about Bernie Madoff?” Right; Madoff got caught and went to prison for one very simple reason…he stole from other rich people.

The truth is that Bernie Sanders scares Wall Street because they don’t own him; he’s in no way beholden to them. Hillary Clinton is a different story. Though she might well be thoroughly incorruptible, her reliance on Wall Street for millions in campaign donations doesn’t paint a picture of someone willing to hold the Lords of the Universe accountable…for anything.

Contempt for the vultures on Wall Street is one of the few things most Americans share. In the last few decades, neither party has done anything to curb the corruption and greed of the financial industry. Indeed, it was a Democrat, Bill Clinton, who did as much as anyone to deregulate the very banks that later wrecked the economy and plundered the public coffers. Although his mythology remains firmly in tact, Ronald Reagan is equally responsible for what happened in 2008.

Part of the reason Bernie Sanders has touched a nerve is that he’s the only candidate running for president who’s credible on this issue. Wall Street prefers a Republican, but they can live with a Democrat. In almost every election, bankers give millions to both sides, hedging their bets if you like. Hence they win no matter what happens.

But Sanders hasn’t taken a dime from Wall Street, unlike President Obama and Hillary Clinton and every other major party candidate. And it’s impossible to overstate the significance of that. It doesn’t mean a Sanders presidency would put an end to financial corruption - that’s naive. But it does give Sanders a rare credibility; against the backdrop of a recession and massive wealth inequalities, that’s a big deal.

As Vice-President Joe Biden once said, “That’s a big fucking deal.” No other candidate from either party has an ounce of credibility when it comes to holding Wall Street accountable. Did you know that Iceland prosecuted the bankers whose irresponsibility and recklessness tanked their economy in 2009? Yet not a single Wall Street financier was tried, much less convicted, for very nearly crashing the entire world economy in 2008? Isn’t about time that changed? And shouldn’t that put the fear of God into those on Wall Street used to acting with impunity?

As Vice-President Joe Biden once said, “That’s a big fucking deal.” No other candidate from either party has an ounce of credibility when it comes to holding Wall Street accountable. Did you know that Iceland prosecuted the bankers whose irresponsibility and recklessness tanked their economy in 2009? Yet not a single Wall Street financier was tried, much less convicted, for very nearly crashing the entire world economy in 2008? Isn’t about time that changed? And shouldn’t that put the fear of God into those on Wall Street used to acting with impunity?

This should be a scary moment in history for those on Wall Street who’ve played chicken with other people’s money for far too long without consequence. Like most Americans, I’m not looking for my pound of flesh, I just want to know that Wall Street is playing by the same rules and living in the same box ordinary Americans are expected to. There shouldn’t be two sets of rules- one for Wall Street and another for mere mortals.

Blankfein (who supported Clinton in 2008) is rightfully concerned about Sanders, whom he doesn’t own. He knows that Sanders isn’t joking, either.

Wall Street has not yet changed its business model; instead of investing and making affordable loans available to small and medium-sized businesses, they continue to come up with complicated financial instruments which I think have the potential to do serious harm in the future. No one will tell you we have a tough regulatory system looking out for Wall Street crimes - we don’t. And yet since 2009, in a weak regulatory environment, these guys have had to pay over 200 billion dollars in fines for illegal action or reaching settlements - that’s rather extraordinary for a weak regulatory environment. God only knows what would happen if you had a strong regulatory environment.

Isn’t it time we found out what would happen in a strong regulatory environment? Isn’t it time we demanded accountability of Wall Street by holding it to tough but fair standards? Isn’t it time criminals on Wall Street were investigated, prosecuted, and held to account like criminals in other walks of life? Having an office in New York’s financial district shouldn’t mean being immune to the laws that constrain the behavior of other, lesser mortals.

We have a golden opportunity to create real change in the way Wall Street is regulated. Again, if it’s “too big to fail,” it’s too big to exist, and there’s precedent for the government forcing businesses too large to be regulated properly to break up into separate companies. Whatever’s needed to regulate Wall Street, I suspect Hillary Clinton will drag her feet and impede progress. Even if by some miracle she doesn’t, she’s taken so much money from Wall Street that she’ll never be free from the taint of suspicion.

Bernie Sanders has no such handicap. Perhaps it’s time we gave the keys to the Oval Office to someone not already arguably corrupted. How else can we know that change- real, tangible, noticeable change- has a chance?